- LifeSearch

When we were collecting data for our Let's Start Talking report, we asked a nationally representative sample of people if they had ever experienced mental health issues. Less than half of them (around 47%) said no. 53% said yes, with 25% still currently dealing with these issues and 28% of people having dealt with them in the past. (For clarity, 5% declined to answer and the total is greater than 100% because respondents were invited to tick all that apply - which is why some people have both previous and current experience)**.

With mental health conditions, we’re referring to a wide range of disorders that affect a person’s thoughts and emotions and by extension their mood and behaviour. Some of these disorders are common and well known, like depression, PTSD, anxiety, stress, postnatal depression, eating disorders, and addictions. Any and all mental health conditions are frequently dismissed or misunderstood, and many people find them difficult to talk about.

The fact is, sometimes even just our lifestyles can be overwhelming and the pressures of modern life can feel like too much. Over the past few years, the nation’s stress has ramped up hugely, with 32% of 18-34 year olds citing work related stress, and 31% of the population wishing they worked less.

If you feel that you might be dealing with a mental health condition - even if you think it’s ‘just work stuff’, it’s important to see a medical professional for a diagnosis and medical help. The unwillingness to talk about certain stuff - mental health conditions especially - stops people who need protection from feeling like they can get it, and it can cost them and their loved ones big time.

The good news is that whilst some scary places on the internet and some ignorant members of the population might have you believing differently, the stigma around mental health issues is lessening. Having a mental health issue no longer has to feel terrifying, debilitating, or lonely.

Whilst waiting lists for doctor’s appointments and treatment can be intimidatingly lengthy, now more than ever the conversation around mental health is rife in the public eye. Having a mental health condition shouldn’t stop anyone from doing anything anymore, including seeking healthcare or insurance.

The rise of mental health issues

When we talk about mental health, we tend to either over or underestimate the scale of the problem. The fact is that more people have mental health conditions than ever. We could blame a lot of things: modern living, global warming… Brexit…COVID-19 (Coronavirus)...etc. But ultimately, all that matters is that it’s really happening.

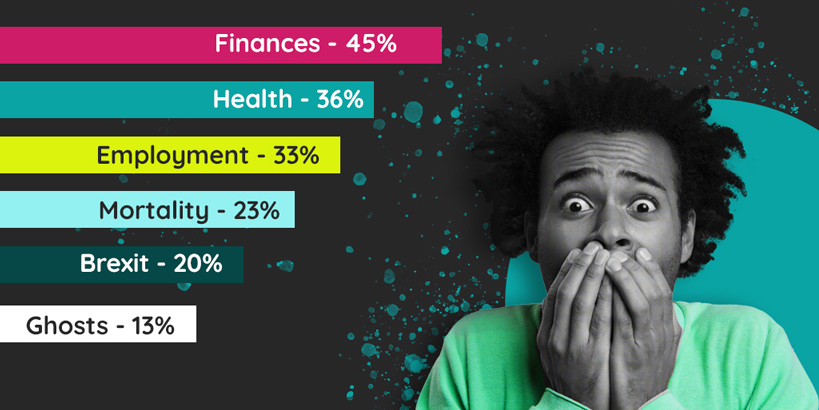

Millennials have been called many things, but what they really are is anxious. Turns out that millennials basically worry about everything all the time.

People aged 55+ are much less worried about the same issues, with finances and health coming in at 20% and 21% respectively, and only 1% of them worried about ghosts.

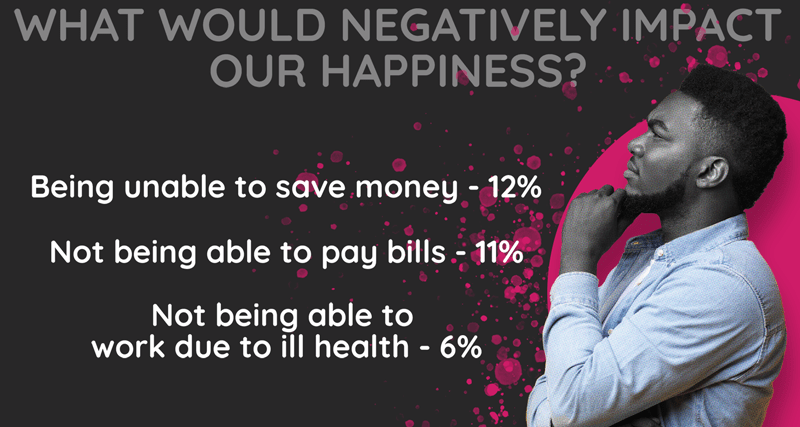

When collecting data for our 2019 Health, Wealth and Happiness report we found that this year the thing we’ve worried about the most as a nation is our happiness. When asked what would negatively impact our happiness the most, 12% of those asked said not being able to save money, 11% said not being able to pay bills, and 6% said not being able to work due to ill health. We also see our much-loved family and friends as the most valuable part of our lives, and time with them as the biggest contributor to our happiness.

When considering these responses, it’s surprising that so many people don’t have any life insurance cover at all - with 30% of viable women and 31% of men left unprotected***. Insurance products won’t cure a mental illness or soothe every anxiety, but they surely will offer a little peace of mind to curb these worries. You see it as life insurance - another thing to spend money on. We see it as protecting the best bits in your life, and removing the nagging worry in the back of your mind about getting sick or dying and not being able to provide for your loved ones.

Not only are mental health issues more of a problem for young people than they ever have been before, but younger people are also investing less into protecting themselves. The higher level of cover/savings etc could be a contributing factor to how much less older people worry. Only 26% of millennials have savings**** for their families if something happens, only 22% have life or critical illness cover, and only 13% have written a will.

The pressure to provide and always be healthy is real, and even affects people who don’t have mental health conditions. Protection products could stop an illness or inability to work from financially crippling you, or help your loved ones continue to live the lives they love after your death. Life insurance can be a comfort blanket. Life insurance (and other insurance products) are optional but provide peace of mind.

Can I get life insurance with a mental health condition?

Whilst we do believe that mental health issues shouldn’t be a barrier to understanding, support, and protection, there’s no cut and dry answer here. The reality is that mental health conditions can have a varied impact on life insurance and other protection products, depending on the provider and the severity of the condition.

What we can say is that a mental health condition from your past will have less impact when taking out a policy than a condition with ongoing symptoms. Applying can be frustrating and may take a little time with many questions to answer, but it’s really worth doing and can give you that much needed peace of mind. Insurers are used to it, but it’s important to be open and honest.

Justine Shaw, a senior adviser here at LifeSearch, says:

"I really do try to build rapport so people feel comfortable disclosing these things to me. It might be good that it’s over the phone, because they don’t see me and they won’t ever see me again. There’s not a day goes by that I don’t speak to somebody who has been affected in some way, shape or form by mental health issues. Although the insurance industry as a whole has been a bit slow to support mental health sufferers, we’re in a better place now than ever before."

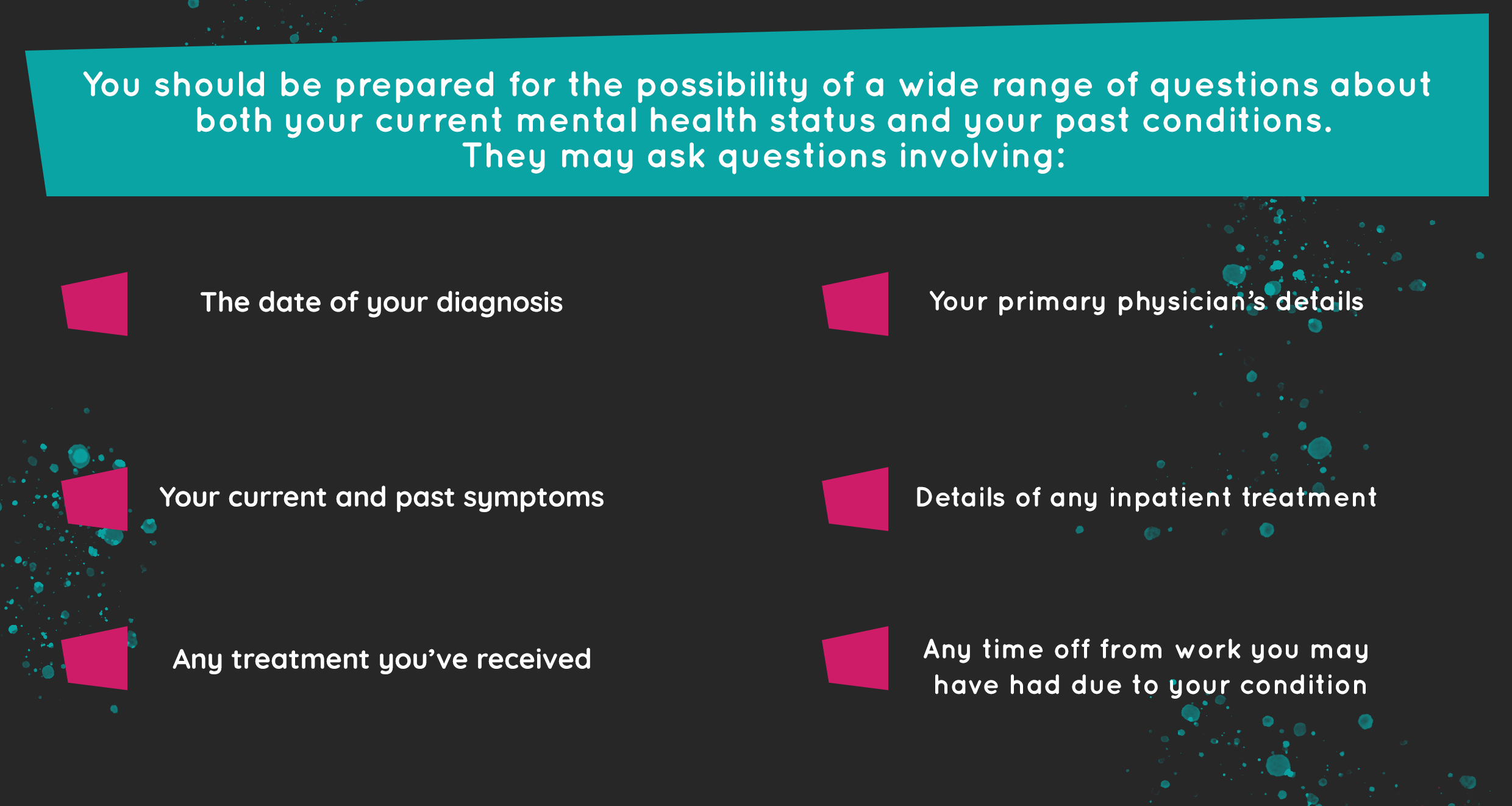

You should be prepared for the possibility of a wide range of questions about both your current mental health status and your past conditions. A provider may ask questions like:

- The date of your diagnosis

- Your current and past symptoms

- Any treatment you’ve received

- Your primary physician’s details

- Details of any inpatient treatment

- Have you ever had suicidal thoughts?

- Have you ever self-harmed?

- Have you ever made an attempt on your life?

But will I be denied life insurance if I have a mental health condition?

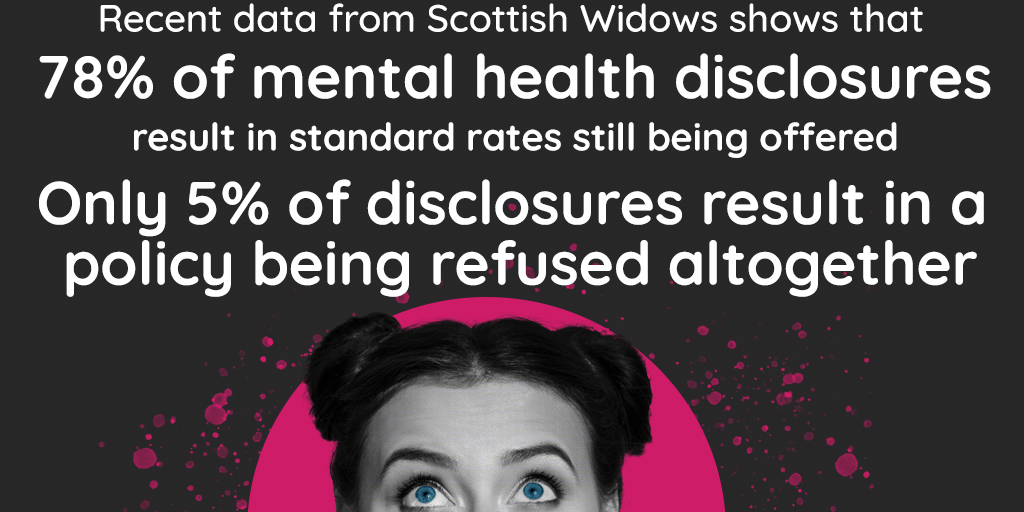

Insurers have historically been super cautious when it comes to mental health conditions, but recent stats from Scottish Widows shows that 78% of mental health disclosures*****receive standard rates and only 5% are declined, so don’t let any previous experiences put you off.

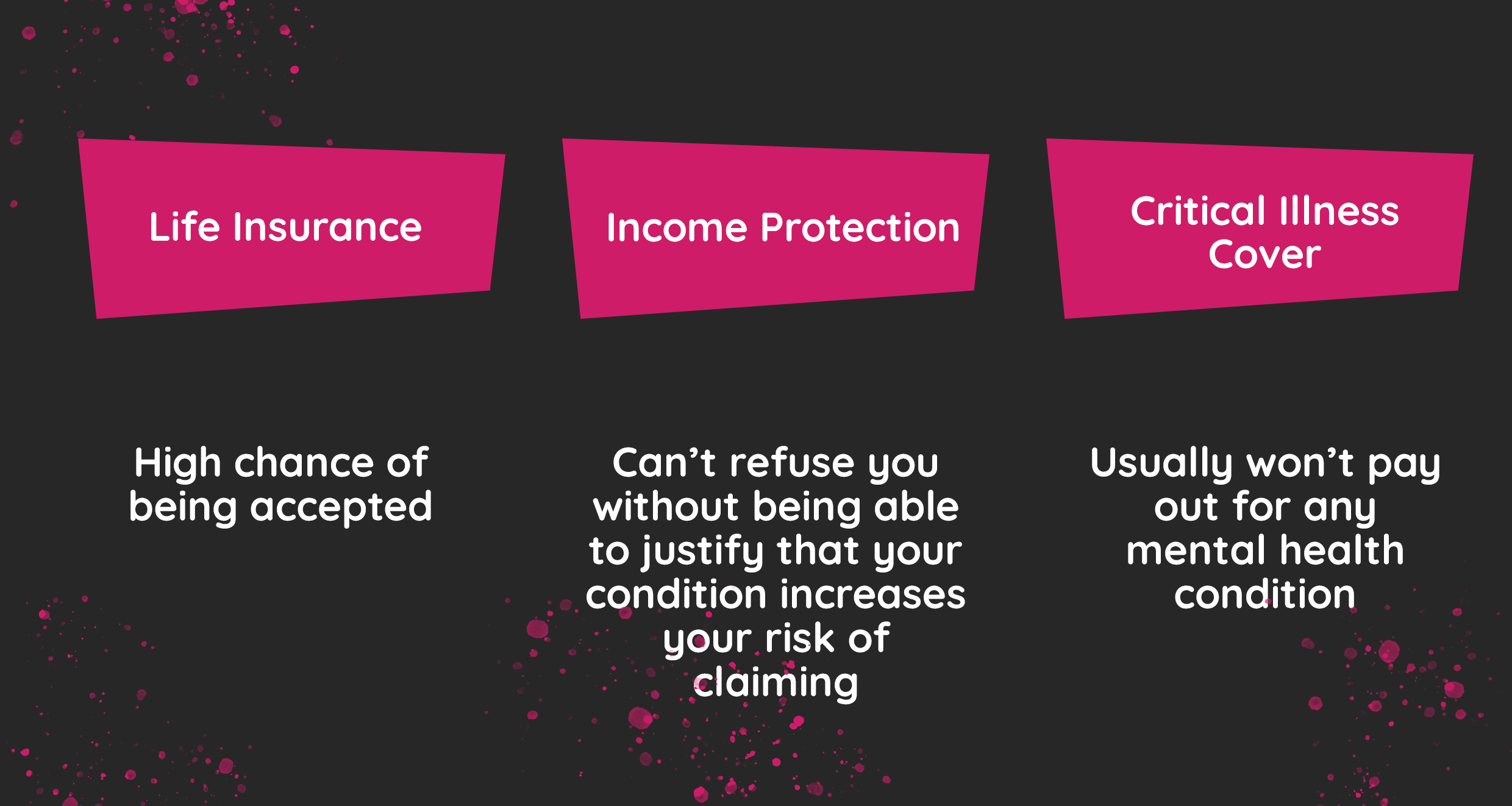

They do need to take a more cautious approach with their underwriting because statistically, you’re more likely to claim for mental illness than for something physical. You could be labelled as a high risk customer, which often results in higher premiums or having your application denied - the same way that it would if you had a pre-existing medical condition such as a heart problem. Insurance providers will be especially wary of a history of any suicide attempts, self-harm, referals to a psychiatrist, or inpatient treatment.

That being said, insurance providers can only legally refuse cover or increase premiums due to a mental health problem if your mental health condition is directly related to the insurance you’re applying for, for instance if you’re applying for life insurance with a history of suicide attempts. Even then, they have to be able to prove that their refusal to cover you or their hike up in pricing is reasonable.

A claim can also be denied due to non disclosure or dishonesty. If you fail to mention that you’re taking antidepressants at the application stage then this could backfire. There’s also a chance that any dishonesty could be considered fraudulent under the Fraud Act 2006. So honesty really is the best policy in this instance!

So, even though insurance providers are wary of mental health issues, things are changing. With the world working hard to lift the stigma around mental health, it’s time for them to be treated the same as physical conditions.

What if I do get denied a life insurance policy?

If you’ve had no luck when trying to take out a policy, there are specialist providers that you can go through that build their business on offering life insurance to those refused elsewhere. If you have a less common mental health condition, like Borderline Personality Disorder or Complex PTSD you may find it more difficult and have to go through a specialist provider - but times are changing and there are many providers and brokers who pride themselves on helping every person find the right cover.

We recommend however that if you haven’t already, try and go through a broker or comparison service such as us here at LifeSearch. We can set you up with the options that best match your situation and your needs and we’ll ensure you don’t end up buying insurance products from less-than-legitimate providers out of desperation.

Is depression covered by life insurance?

Depression and anxiety are two of the most common mental health conditions. Many of us have bad days, or external issues that make us feel rubbish for longer periods of time, but depression can be completely debilitating in its severest forms. It can make functioning almost impossible and can even result in hospitalisation.

The stats aren’t fun to hear, but with 1.4% of all deaths in 2016** being from suicide and between 10 and 20 million non-fatal suicide attempts a year, it’s easy to understand why it’s most insurance provider’s main concern when providing life insurance for someone with depression. Despite this, most insurance providers will actually pay out in the case of suicidal death within a year after the policy is bought. This differs slightly from provider or provider but tends to be standard practice.

And that’s not the only reason why depression may make you a high risk applicant for many providers. Depression and poor physical health are also often linked, as depression can often lead to poor diets, alcohol and drug addiction, risky or impulsive behaviour and little to no management of other health issues. With poor health, the likelihood of a claim increases.

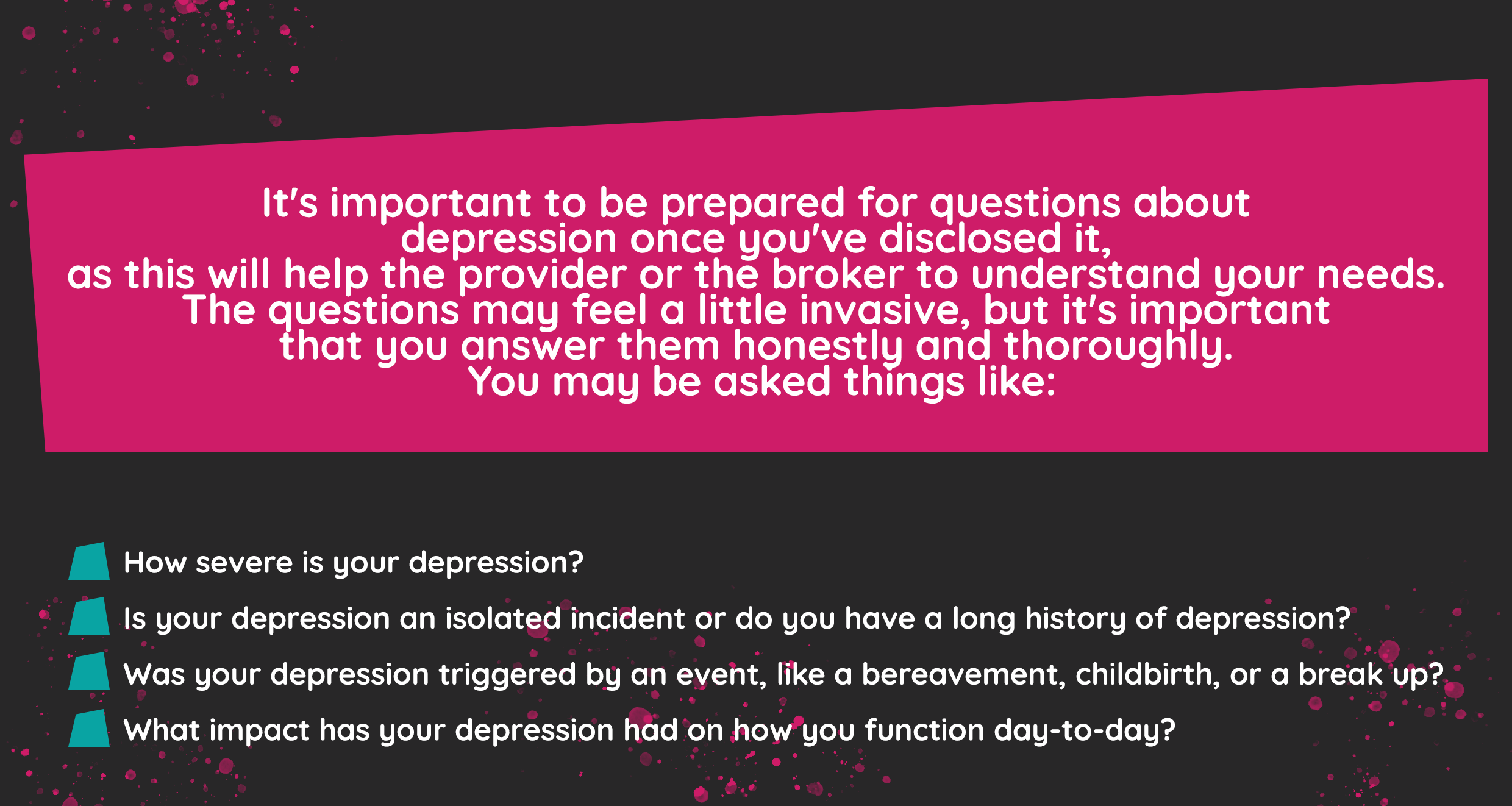

As with disclosing any mental health issues, you’ll be asked some personal questions about your depression so that the provider can understand your needs. They may feel a little invasive, but you could be asked things like:

- Is you depression an isolated incident or do you have a long history of depression?

- Was your depression triggered by an event, like a bereavement, childbirth, or a break up?

- What impact has your depression had on how you function day-to-day?

- Have you had to take time off work for your depression?

- Are you on any medication for depression?

If you’re not currently depressed but have disclosed a history of depression, you may be asked further questions to find out more about your previous condition.

Being able to buy life insurance with depression will take a little more time and effort than usual and will rely on your openness. You’ll need to be:

- Honest. Disclosing every detail about your health is vital, otherwise any claims could be deemed illegible.

- Compliant. A history of compliance with doctor’s orders can help you to be approved. Avoiding treatment will make insurance providers wary.

- Thorough. Like we said, leave no stone unturned when it comes to the detail; medications you’ve been on and for how long, any side effects or any related conditions you’ve been diagnosed with.

Will I be refused life insurance because of depression?

It does happen. However, Duncan Nash, a LifeSearch Senior Adviser, says that “today, if a customer says they have thought about self-harm, one insurer might not have any interest in scrutinising it, while another might see it as a red flag. But the thing about working with so many insurers is that you can ask questions and immediately remove the ones that won’t fit and narrow down more suitable options for the customer.”

It’s possible that you’ll have an easier time if there’s a tangible external ‘reason’ for your depression - like a bereavement or break up. Conditions like post-natal depression tend to be viewed more favourably than chronic depression as they’re viewed as isolated incidents less likely to result in a claim.

Other insurance products and mental health conditions

You could also consider Income protection. This product provides you with a monthly sum of money if you cannot work due to illness or injury. Some income protection providers will consider those with mental health issues but stress and depression are some of the most common reasons for a claim, so you’re automatically a high risk.

The approach taken towards your application or claim will differ from provider to provider, but it’s likely that you’ll be facing higher premiums, unless you can prove that you’ve been symptom free for a good while. Under the Disability Discrimination Act, it’s illegal for insurers to turn down or charge higher premiums to those trying to buy income protection without being able to prove that the risk of a claim is increased by their condition. They must justify this decision and do a risk assessment on each applicant, working on a case-by-case basis.

Times are a’changin’ when it comes to taking out insurance with a mental health condition, but it’s worth factoring in the possibility of having to pay increased premiums.

How to apply for life insurance with a mental health condition

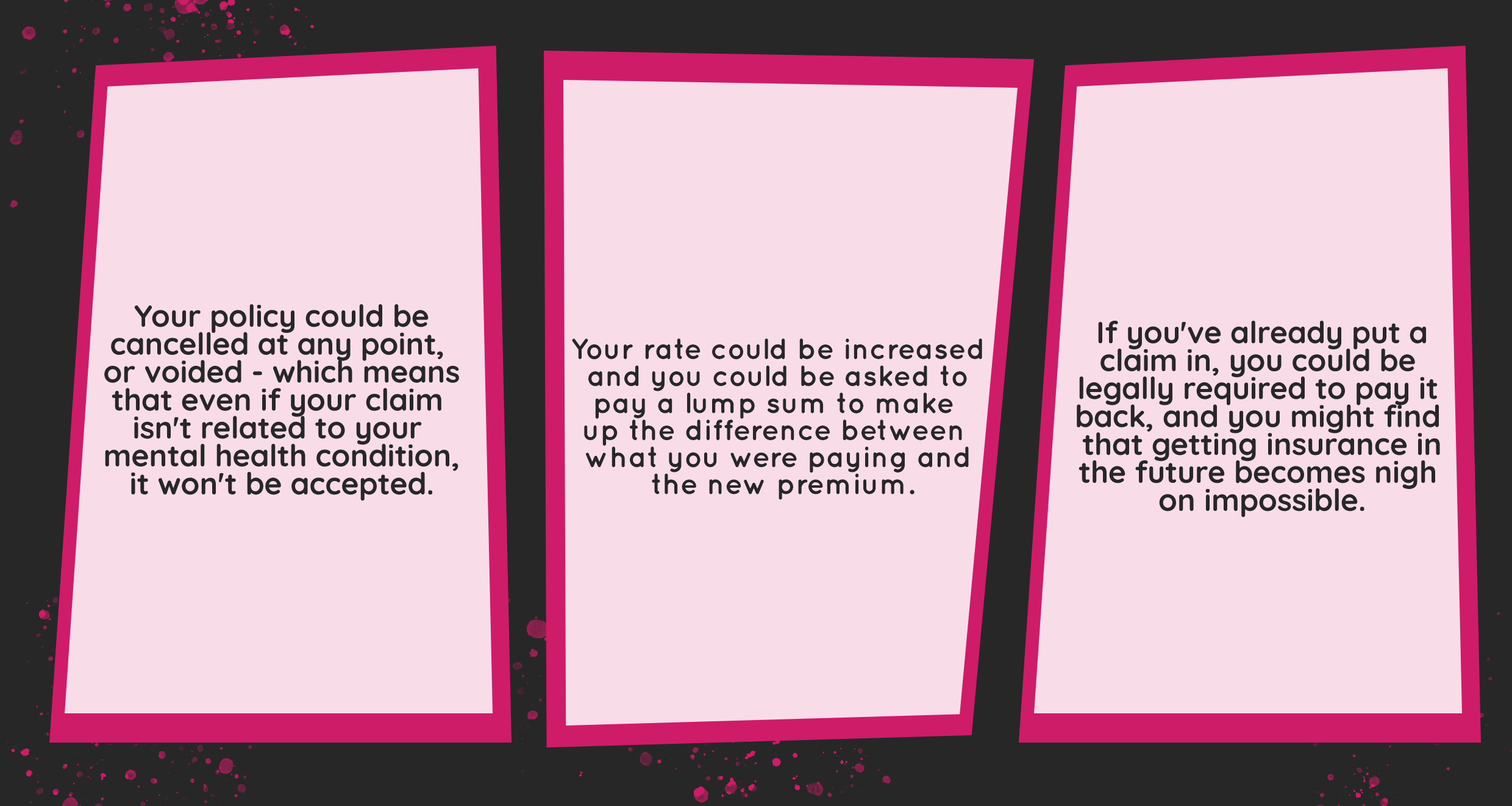

If you haven’t guessed by now, it’s so important to be honest about your medical history when applying for insurance products, even if it’s been years since you had any issues. It’s understandable to not want to mention a history of mental health issues to avoid being declined, but there could be some unwanted consequences to not being open and honest:

- Your policy could be cancelled at any point, or voided - which means that even if your claim isn’t related to your mental health condition, it won’t be accepted.

- Your rate could be increased and you could be asked to pay a lump sum to make up the difference between what you were paying and the new premium.

- If you’ve already put a claim in, you could be legally required to pay it back, and you might find that getting insurance in the future becomes nigh on impossible.

It can help if you provide a doctor’s report to your provider. Your GP or psychiatrist can provide in depth explanations of your condition which means the provider has accurate unbiased information. This transparency is important.

If your mental health condition makes functioning on the small stuff difficult, even just the application process can knock you for six. Don’t be afraid to ask the provider for adjustments to help you through the process, such as:

- Extensions on deadlines to give you more time to mull over the small print.

- Communications going through a third party, like a family member, legal advocate or a friend that you’ve asked to help you.

- Applying via a snail mail letter rather than over the phone or online.

- Using an intermediary such as LifeSearch to be the middle-man and help you through the process.

Even if you’ve been rejected and you feel like it’s the end of the insurance policy road, don’t just go for the cheapest policy available, or go with a non-advised firm because they’re the only ones that immediately offer you cover. Take the time to explore your options and ensure that what you’re offered covers you the way you want to be covered. If all hope seems lost, remember you can try to go through a specialist provider or a broker.

It’s also important to note that taking out life insurance gets more expensive as you get older. The typical 40 year old’s policy is perhaps double what your average 20 year old is paying. It’s advised to take out protection products sooner rather than later and to take them out for as long as possible. Don’t wait to feel old or sick enough, as you’ll be faced with more expensive premiums.

Brought to you by our partner, LifeSearch